Taxes are, for many, inevitable. As the adage goes, “there are only two certainties in life; death and taxes,” (although this has mutated into something of a metaphor for worn-out maxims). However, as we discussed in a previous article, for the very wealthy, taxes are not so inevitable. Depending on your view, you may find the next question profoundly strange: who wouldn’t want to pay taxes?

Some members of society feel exploited by their government’s taxation system. Who wants to be hoodwinked out of a sizeable percentage of money every month? With this in mind, today we look at some of the various forms of taxation that are, in some form or another, employed in countries around the world. We may just find the source of ire of our morose taxpayers.

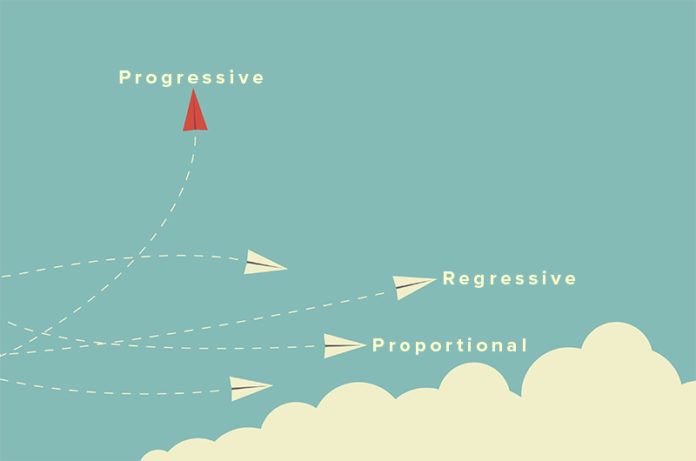

Progressive and (Regressive) Tax

We’ll use income tax as an example of how progressive tax is employed. Progressive tax describes a system in which tax is paid incrementally as wages increase; you earn more, you pay more. A regressive tax, on the other hand, does the exact opposite; as income goes up, the tax bill comes down.

Income tax in the UK is an example of a progressive tax: each UK citizen is not required to pay income tax on the first £11,500 earnt. Every pound earned between £11,501 and £45,000 is taxed at the basic rate of 20%; every pound earned between £45,001 and £150,000 is taxed at 40%; finally, every pound earned over £150,000 is taxed at 45%.

Cigarettes are often used as an example of a regressive tax. Those who smoke the most pay the highest amount of tax (this is typically higher in deprived areas of England according to Cancer Research UK). Another example would be the TV license, not a tax per se, but it uses a similar structure as it funds public television. A TV licence costs the same for each household, regardless of how many TVs are in the house (and the size of the house). Now take into account that the wealthiest 10% of households own 50% of the UK’s household wealth; in comparison, 90% of households pay a disproportionate amount of their household wealth for a TV license. The bottom 90% pays a disproportionately large amount in comparison with the top 10%.

Above we used an example of direct and indirect tax: direct tax comes straight from an individual to the government; indirect tax is added onto sales and is paid to the government via a third party (a retailer, for example).

If we take into account all indirect taxes in the UK, you would see that the overall indirect taxation system is regressive. However, if all direct and indirect taxes are taken into account, the UK is an example of a progressive tax system overall.

Proportional Tax

Sometimes called a flat tax, proportional tax works by taking the same percentage from all taxpayers. The government would take, for example, 10% for each taxpayer regardless of their income. Where most of the tax money comes from in a proportional system depends on how the income of the country is distributed. Here’s a straightforward example to illustrate what proportional tax would look like:

There are twenty people in our hypothetical nation; they are divided into three groups:

Group One consists of ten people, and they each earn £20,000 a year.

Group Two consists of seven people, and they each earn £40,000 a year.

Group Three consists of three people, and they each earn £60,000 a year.

Our proportional tax rate is 10% of income.

Citizens of Group One each pay £2,000 a year in tax.

Citizens of Group Two each pay £4,000 a year in tax.

Citizens of Group Three each pay £6,000 a year in tax.

The final tax totals are:

Group One: £2,000 x 10 = £20,000

Group Two: £4,000 x 7 = £28,000

Group Three: £6,000 x 3 = £18,000

Is this fair? The largest group (One) pay less than the middle group (Two) but more than top earners (Three). On the other hand, the largest group (One), who are more likely to use the public services taxes pay for, pay significantly less than Group Two which is only marginally smaller. As you can see, creating a fair tax system with an extremely limited number of fictional taxpayers is not easy. You could also factor in the costs paid through an indirect tax on things like VAT which could change the picture entirely. Would we then decide to charge VAT progressively so top earners pay a higher VAT percentage?

Depending on your view, taxation may seem particularly unfair. However, as former US Supreme Court Justice Oliver Wendell Holmes said, “taxes are what we pay for civilised society,” and if civilised society has been particularly beneficial for you, why shouldn’t you give back more? That goes for every form of tax; it may seem draconian to charge a higher VAT for those who earn more, but some may argue that earning more money is another direct benefit of being a citizen.

Interesting in studying the intricacies of tax? An accounting qualification will give you plenty of opportunities to debate which side of the fence you’ve chosen to sit on. Contact Aspiring Accountants today to find out which accounting qualification fits your professional needs.